The Goods and Services Tax GST will be set to zero percent 0 effective from 1 June 2018 as announced by the Ministry of Finance Malaysia on 16 May 2018. With GST prices of goods and services could.

Notice Gst Zero Rated Enagic Malaysia Sdn Bhd Facebook

All supplies of local and imported goods and services which are now subject to GST at the standard rate of 6 will be subject to GST at zero rate 0 beginning 1 June 2018.

. So the standard-rate will automatically become zero-rated come 1 June but exempt supply will remain exempted from tax. Standard rated GST supplies. The Goods and Services Tax GST Board of Reviewin a decision favourable to the traderaddressed the tax authoritys decision to deny zero-rating for exports of goods that were hand-carried by motor vehicle to customers in Malaysia.

The case is. Computation of GST on zero rated supply. Your services are considered international services which are zero-rated ie.

Image via Bernama via NST. A young boy poses with a poster asking for the GST to be abolished during a May Day rally in Kuala Lumpur on May 1 2014. Computation of GST on zero rated supply.

The Goods and Services Tax GST. Jabatan Kastam Diraja Malaysia Appendix 2 - Guide to enhance your accounting software to be GST Compliant Draft as at 13 March 2014 SR. GST code Rate Description.

As such the rate reduction from the current 6 to 0 will be reflected on transactions related to MYXpats charges from 1 June 2018 onwards. Depending on the nature of your services you may be required to determine your customers belonging status ie. GST is charged at 0 if they fall within the provisions under Section 21 3 of the GST Act.

Businesses are eligible to claim input tax credit in acquiring these supplies and charge GST at zero rate to the consumer. Depending on the nature of your services you may be required to determine. Zero rated GST will be applicable on future appointments even though they have been booked before the GST rate change.

After spending the last several hours and night reading through the GST Act talking to tax accountants GST experts and scouring. GST is a broad based consumption tax covering all sectors of the economy ie all goods and services made in Malaysia including imports except specific goods and services which are categorized under zero rated supply and exempt supply orders as determined by the Minister of Finance and published in the Gazette. After you change the tax group rate from 6 to 0 in Zenoti when you open any invoice that has a GST rate of 6 a link to recalculate appears.

Under this category the taxable company doesnt need to collect any GST on sales. The existing standard rate for GST effective from 1 April 2015 is 6. Malaysia has introduced a Goods and Services Tax GST of six per cent.

How GST works on a zero rated supply. The ministry said the GST will no longer be imposed at a rate of 6 per cent from then on adding that this will be subject to further notice. Malaysias GST is zero-rated starting from 1 June 2018.

Previously only certain goods and services. GST is charged at 0 if they fall within the provisions under Section 213 of the GST Act. GST zero rated from June 1.

Some inbound agents are proactively working to reflect the new zero-rated. When you click the link a 0 tax is applied on the invoice and the price is. The Standard-Rated SR code is for.

Malaysias unpopular 6 per cent GST was zero rated by the new Mahathir Mohamad administration to fulfil an election promise. Zero rated supply of goods or services locally. The GST will be fully scrapped after the government repeals the Goods.

What is GST Zero-Rated Supply in Malaysia. The Goods and Services Tax GST is an abolished value-added tax in Malaysia. 2 Where a taxable person supplies goods or services and the supply is.

In other words no effect la so we dont have to go too deep into this. Businesses are eligible to claim input tax credit in acquiring these supplies and charge GST at zero rate to the consumer. 1 A zero-rated supply is a any supply of goods or services determined to be a zero-rated supply by the Minister under subsection 4.

GST zero-rating for sales of exported goods. As the name suggests GST zero-rated supply means that the goods and services that fall under this category are not taxed. The Goods and Services Tax GST in Malaysia will be set to zero percent 0 effective 1 June 2018.

Dont panic this one only requires a short explanation. How GST works on a zero rated supply at the wholesale level. These are taxable supplies that are subject to a zero rate.

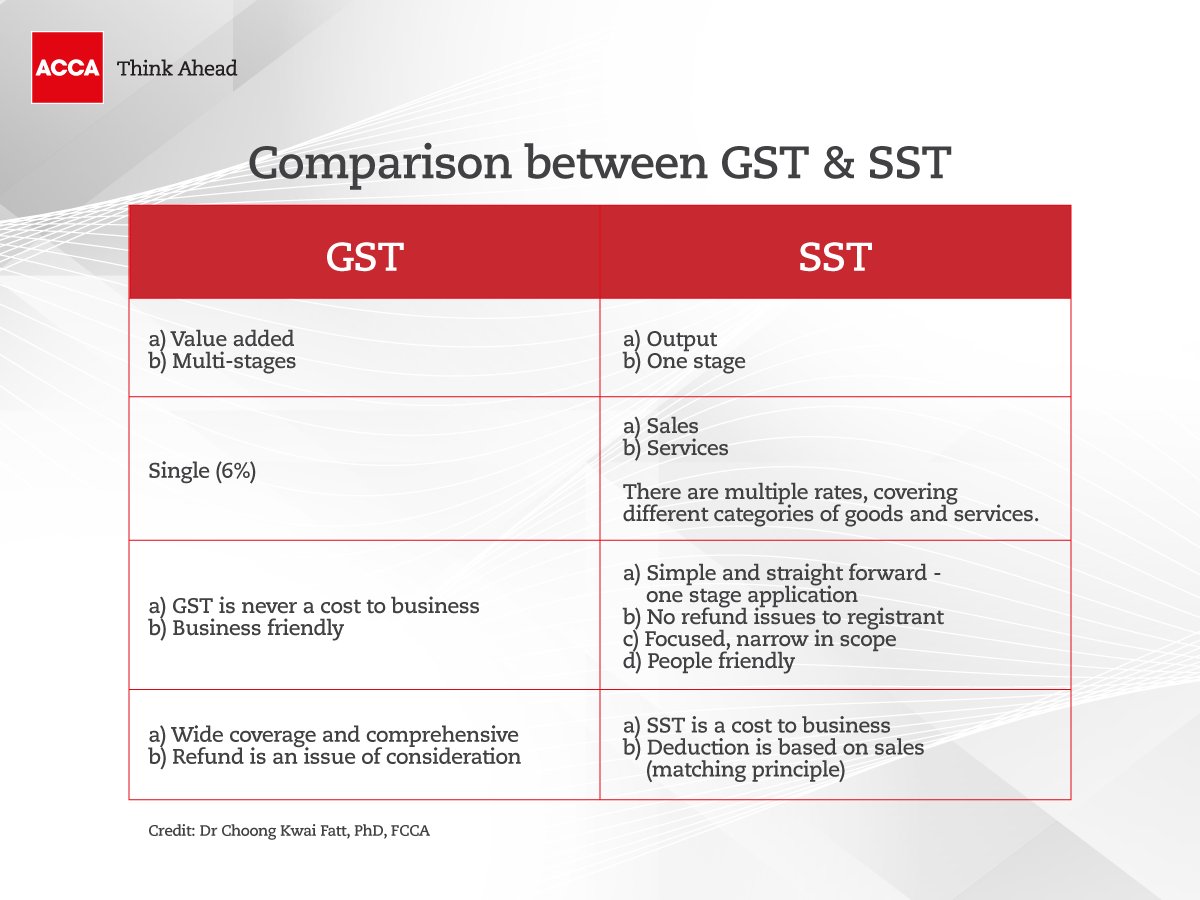

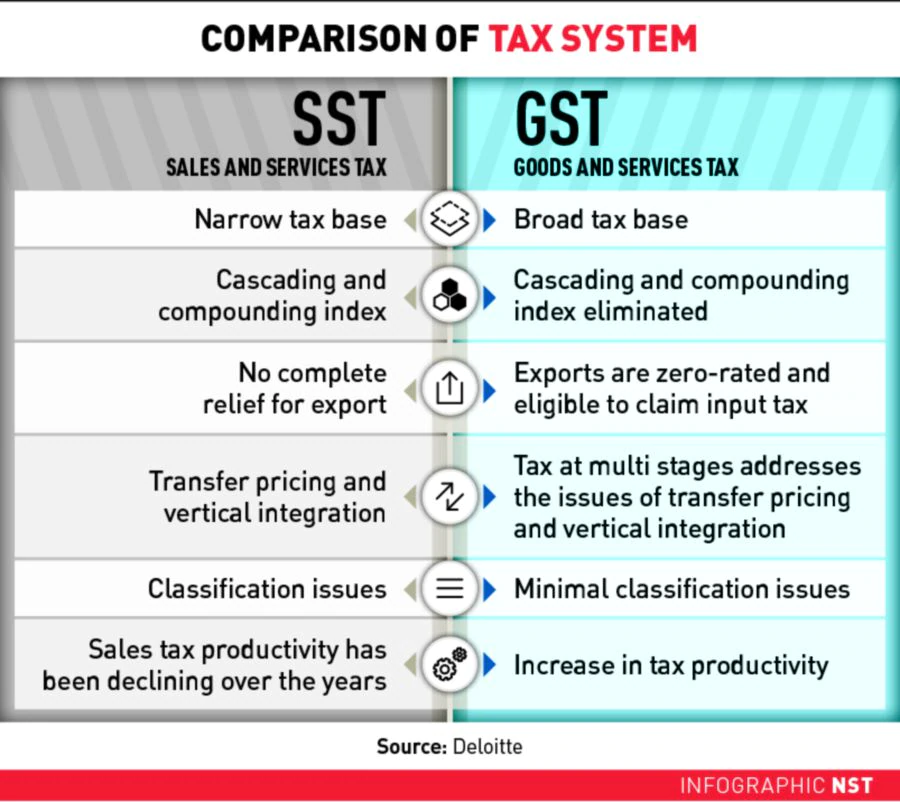

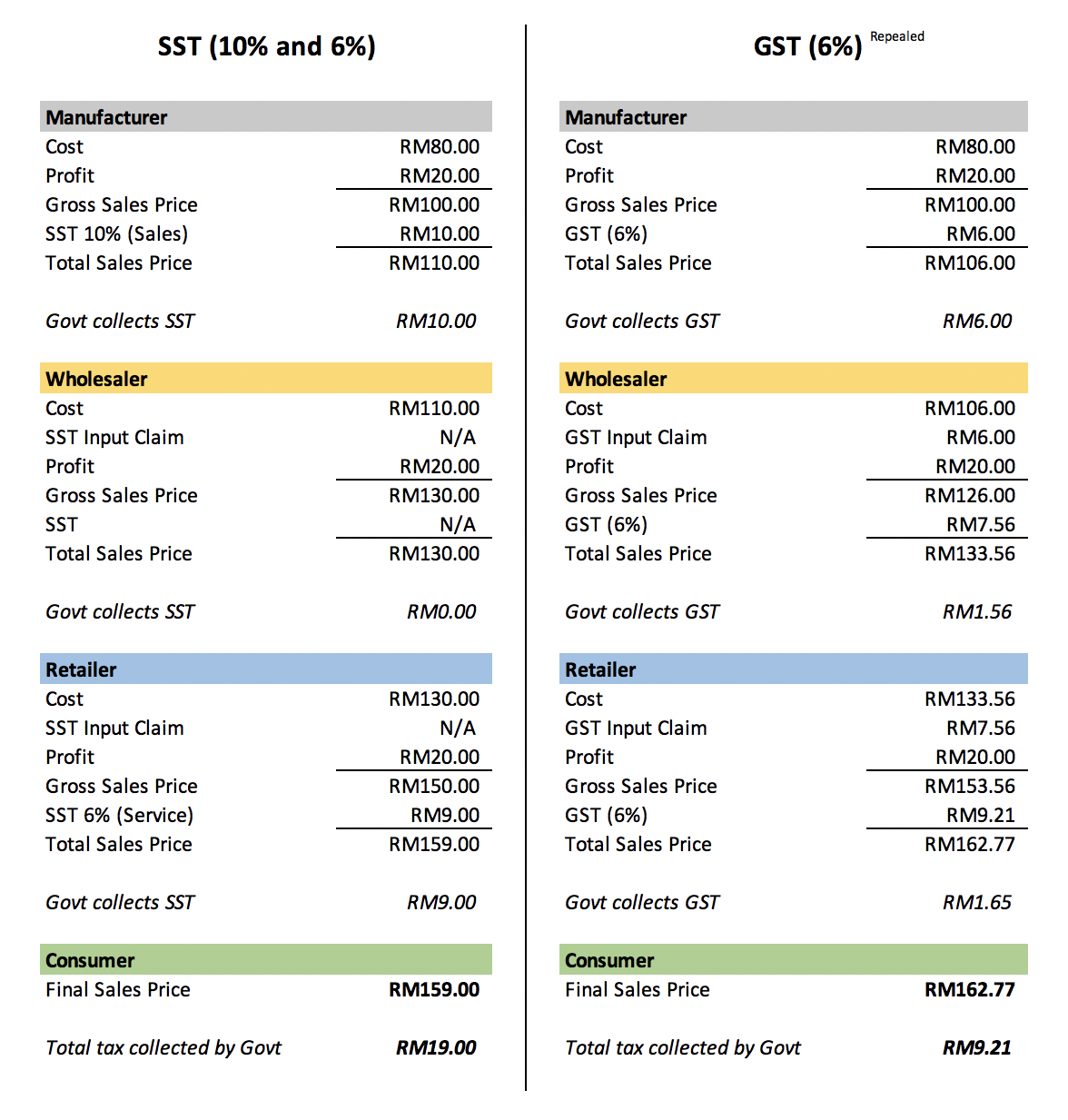

The Goods and Services Tax GST will be zero-rated for all items and services in Malaysia from June 1 2018 the Finance Ministry announced today. Business owners in Malaysia. GST replaces the Sales and Services Tax SST of up to 10 per cent.

But the company is most certainly. An event management company charges a fee for organising a concert in Malaysia. Export of zero rated goods or services.

Typically the Zero-Rated ZR code is reserved for zero-rated supplies such as beef rice sugar water and electricity. How GST works on a zero rated supply. Here is what companies should know about the change in the tax environment of the country.

In other words they are subject to zero percent tax rate. How GST works on a zero rated supply at the wholesale level. Your services are considered international services which are zero-rated ie.

These are taxable supplies that are subject to a zero rate. Whether the customer is a local or an overseas entity. And b any supply of goods if the goods are exported.

In Malaysia theres standard-rated which is 6 zero-rated 0 and exempt GST. GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer. An industry hopeful of the benefits that Malaysias latest tax changes will bring is reacting in different ways as the zero-rated goods and services tax GST policy kicks into place starting today until August 31 after which it will be replaced by the sales and services tax SST from September 1.

Companies are still required to adhere to the zero-rate and continue to comply to all GST requirements under the current legislation which includes the issuance of tax invoices GST tax codes.

Accamalaysia No Twitter As We Bid Farewell To Gst And Welcome Back Sst It Is Crucial To Understand The Differences Between These Taxes Learn About The Taxes Today And Seize This Opportunity

How Is Gst Beneficial For The Country How Would It Help To Improve The Country S Economy Quora

Notice Gst Zero Rated Effective On June 2018 Enagic Malaysia Sdn Bhd

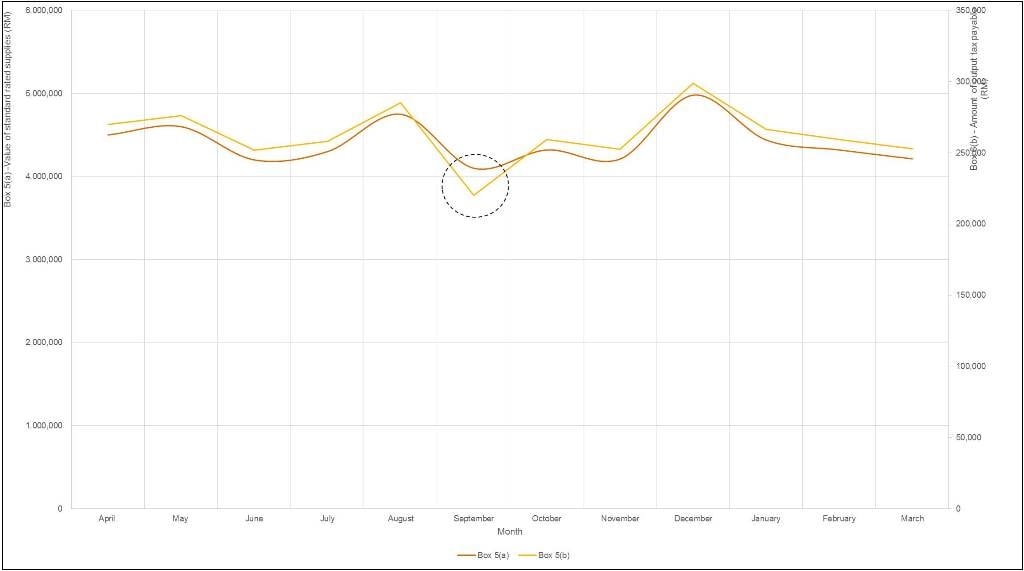

The Amount Of Monthly Gst Collections Has Reached Trillion Marks For The First Time Since The Beginning Of Gst Registration Which Ind Trillion Marks Banksters

Pdf Understanding Of Goods And Services Tax Gst And Spending Behavior Among Malaysian Consumers Semantic Scholar

Gst Global Perspectivegoods And Services Tax In Australia Consumption Tax Is Called Value Added Tax Consumption Tax Personal Finance Presentation

Malaysia S Zero Rated Gst A Move Forward Or Several Steps Back Priority Consultants

Post Ge14 Gst To Be 0 From June 1 But M Sians Still Have Questions

A Guide To Gst In Malaysia How Does It Affect Me

A Guide To Gst In Malaysia How Does It Affect Me

Pdf Goods And Services Tax Gst In Malaysia Behind Successful Experiences

A Guide To Gst In Malaysia How Does It Affect Me

Business As Usual But Customers Reap Rewards As Zero Rated Gst Kicks In Across The Causeway Today

A Guide To Gst In Malaysia How Does It Affect Me

How Is Malaysia Sst Different From Gst

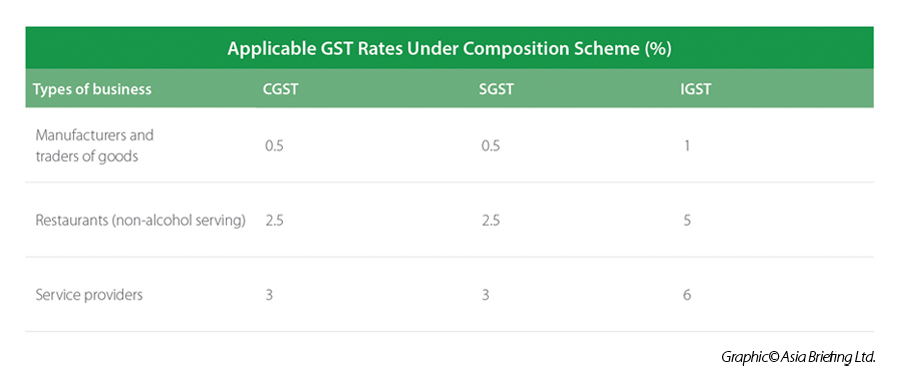

What Is Gst In India Tax Rates Key Terms And Concepts Explained India Briefing News

How Is Malaysia Sst Different From Gst